Delta Charge secures $4.3m to electrify European logistics and industry

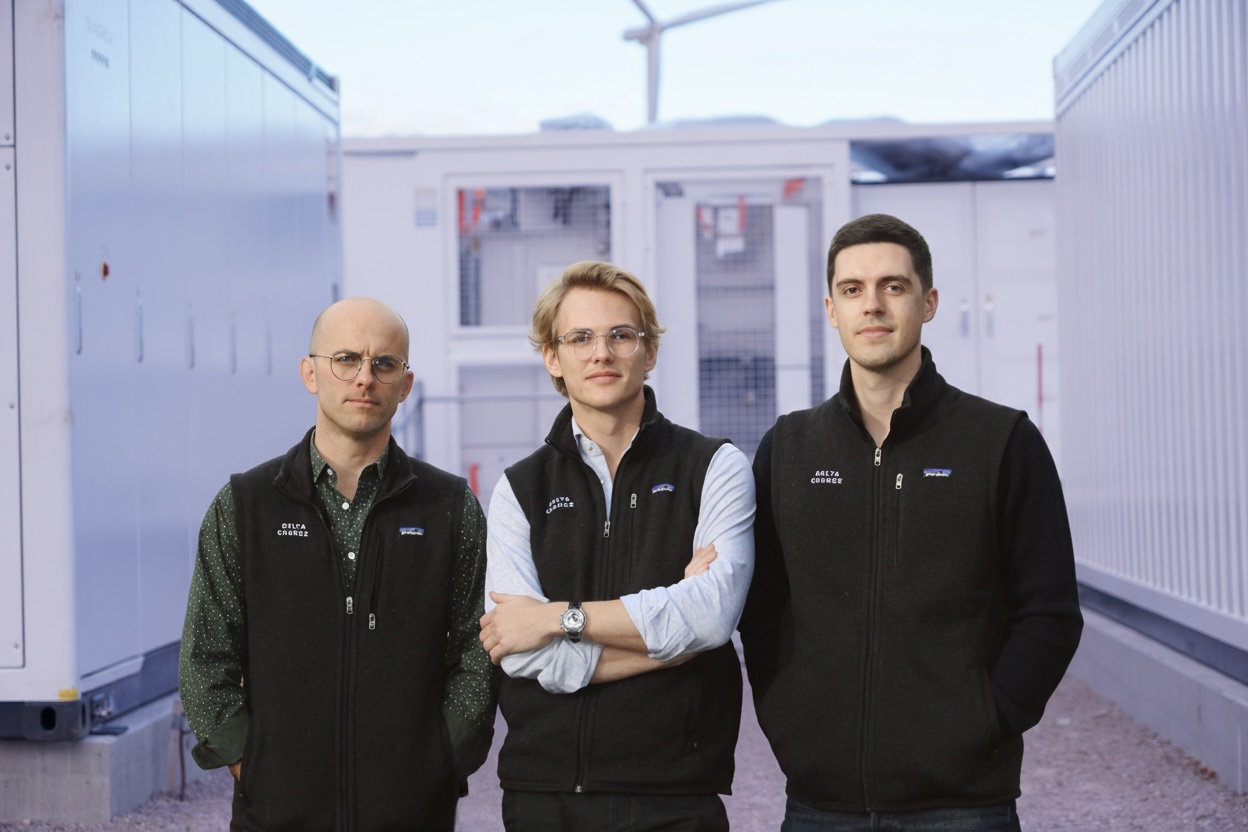

Munich, 20 November 2025 — Delta Charge, a Swedish-German company that is pioneering charging and battery storage solutions for electric trucks, has raised $4.3m equity in an oversubscribed funding round led by Vireo Ventures and Rethink Ventures. The round includes executives from Audi and Allianz, German family offices and founders of Munich’s climate tech ecosystem. The funds will accelerate the growth of Delta Charge’s pan-European network of truck-charging depots and battery-enabled industrial hubs.

Founded in 2024 in Munich, Delta Charge combines battery energy storage systems (BESS) and charging hardware, energy management, and fixed-price charging services to enable European logistics and industry to unlock the economic advantages of large-scale energy operations. Backed by Delta Capacity, one of Scandinavia’s leading battery storage developers and investors, Delta Charge aims to deploy more than €300 million in infrastructure and deliver 1.8 TWh annually of clean energy by 2030.

“This financing marks a defining moment for Delta Charge as we scale our platform and continue to execute our vision,” said Filip Hes, CEO of Delta Charge. “We are seizing a once-in-a-decade opportunity to serve historic load growth and shape a new infrastructure asset class at the heart of Europe’s energy transition. With Rethink’s ambition to redefine transportation and Vireo’s strong commitment to European electrification, as well as Delta Capacity’s experience executing large scale battery projects, we are uniquely positioned to accelerate deployment across our pipeline.”

The announcement comes at a time when heavy-duty electrification is driving unprecedented load growth that could soon rival or even exceed the electricity consumption of Europe’s data centers. As transport could account for almost 50% of the continent’s CO2 emissions by 2030, logistics and freight operations present one of the largest untapped opportunities to substantially cut emissions while reducing per-kilometre costs.

“Operating electric truck fleets at the lowest possible total cost of ownership will rely on smart depot charging solutions that combine battery storage, charging infrastructure, and seamless software integration,” added Jens Philipp Klein, General Partner at Rethink Ventures. “The team at Delta Charge brings deep expertise across energy infrastructure execution, advanced battery software, and a track record of raising hundreds of millions towards rapidly scaling and executing infrastructure pipelines.”

With grid capacity tightening and permitting slowing, depot-based charging and battery storage are projected to attract more than €7 billion in investment by 2030. Positioned at the intersection of logistics and energy flexibility, Delta Charge aims to anchor the infrastructure powering Europe’s zero-carbon freight future.

About Delta Charge

Founded in 2024 by Filip Hes, Johannes Kirnberger and Connor Hanafee, Delta Charge is a Swedish-German energy infrastructure company pioneering end-to-end charging and battery storage solutions for Europe’s freight sector. The company develops and finances a pan-European network of truck-charging depots and battery-enabled industrial hubs. Its platform combines intelligent software, grid-connected batteries, and fixed-price charging services to help fleet operators electrify their operations while supporting a more flexible and resilient power grid.

Backed by Delta Capacity, one of Scandinavia’s leading battery energy storage developers, Delta Charge is led by a founding team with deep expertise across energy infrastructure, advanced battery software, and large-scale project financing. The company aims to deploy over €300 million in infrastructure and deliver 1.8 TWh of clean energy annually by 2030, anchoring the backbone of Europe’s zero-carbon freight future.

Pionix secures more than €8M to unify global EV charging with open-source technology

Pionix raises over €8 million to scale EV charging enterprise products on the open-source EVerest stack, hosted by Linux Foundation Energy (LF Energy), which allows the industry to build on a shared software foundation.

The open-source approach accelerates innovation while dramatically improving reliability, interoperability and long-term maintainability across the global EV charging ecosystem, which currently sees failed charging session rates of up to 25%.

The EVerest stack is considered a highly impactful open-source initiative within the cleantech space, with an estimated ecosystem value of more than $500 million.

Karlsruhe, GERMANY – 18 November 2025

The German e-mobility tech startup, Pionix, has raised over €8 million to scale its open-source-powered products for the global e-mobility industry. Built on the EVerest stack, Pionix offers a suite of engineering and enterprise services to unify EV charging technology under a common framework. The late seed round was led by Ascend Capital Partners, with participation from Start-up BW Seed Fonds, managed by MBG Baden-Württemberg, Pale blue dot, Vireo Ventures, Axeleo Ventures and further investors.

Despite rapid development across e-mobility in recent years, EV charging remains fragmented. The industry’s growing ecosystem of hardware and software companies operates proprietary, closed software systems that often fail to communicate seamlessly with one another. Failures in interoperability and communication have led to reliability issues, inefficient maintenance of infrastructure and charging session error rates of up to 25%.

Founded in 2021, Pionix’s products offer a shared software foundation for all EV charging technologies, ensuring reliability, interoperability and future-readiness of global infrastructure. In response to the industry’s challenges, Pionix initiated and contributed significantly to EVerest, an open-source software platform. EVerest serves as a common foundation for charger manufacturers, charging operators, automakers and fleets to build on, eliminating compatibility issues and enabling faster innovation across the EV charging ecosystem.

Today, EVerest has grown into one of the most impactful open-source initiatives in cleantech and with support from 600 contributors from more than 70 organizations and powers hundreds of thousands of chargers globally.

The open-source software, donated by Pionix in 2021 to Linux Foundation Energy (LF Energy), has an estimated ecosystem value of more than $500 million – already almost half of the estimated ecosystem value of the Linux kernel, which is considered the world’s most renowned open-source project at roughly $1.2 billion.

encentive opens up billion-dollar market and receives 6.3 million euros in seed funding

encentive opens up billion-dollar market and receives 6.3 million euros in seed funding

In a seed round, software company encentive has raised 6.3 million euros in fresh capital. The round was led by renowned global investor General Catalyst and other existing investors. encentive’s AI-driven platform helps industrials automatically cut energy costs by up to 20% and reduce CO₂ emissions – a billion-euro market opportunity as industries face rising costs and climate pressure. The funding will be used to expand their AI-driven platform to connect to even more industrial assets,unlock new markets, and strengthen its technological leadership. Earlier in2024, the company had already secured €2.7 million from investors such as Summiteer, SI Ventures, Vireo Ventures, Interface Capital (Christian Reber), OMA Ventures, as well as well-known business angels including Mario Götze and Stefan Müller.

Flexibility: Using AI to counter rising energy costs and emissions

“Rising energy costs and mounting decarbonisation pressure are challenges faced by almost every industrial company today. Businesses unable to flexibly and intelligently manage their energy flows and adapt to the volatility and fluctuating prices of renewables are already putting their competitiveness at risk. Our solution enables companies to harness the economic potential of flexibility without interfering with existing processes. In doing so, our clients safeguard themselves against economic uncertainty and location disadvantages in the long term,” explains Torge Lahrsen, COO of encentive.

With flexOn, encentive has developed an AI-driven software solution that enables industrial companies to manage their energy consumption flexibly, cutting electricity costs by up to 20% and significantly reducing CO₂emissions. The platform leverages latent flexibility in refrigeration, heating processes, batteries and production lines, generating intelligent schedules and automatically controlling these assets.

Through AI-driven data analysis and optimisation algorithms, energy flows are aligned in real time with the availability of renewable energy. This allows companies to draw on on-site generation or tap into the intraday spot market exactly when wind and solar power are abundant and low-cost. flexOn is primarily used by medium-sized and large industrial players with annual consumption of at least two gigawatt hours (GWh).

Scaling the platform – new industries, new markets

The solution is already in use at leading companies such as Metro Logistics, Dachser and Klingele, and is now also being deployed by well-known utilities as a flexibility platform. To expand into further sectors and markets, encentive will invest the additional funds in new talent as well as in scaling core areas of the platform. This will enable major customers and partners to integrate flexOn independently via a dedicated onboarding suite.

“With the fresh capital, we are investing specifically in further developing our platform and expanding our team. Together, we are driving forward the only AI to date that is directly integrated into industrial machine rooms to actively control systems, thereby setting technological standards. Our vision is to become the leading address for controlling energy flows in industry. The seven-figure order volume from our core industries underscores the success of our solution and confirms our commitment to establishing flexOn as the standard for intelligent energy management – scalable and deeply integrated,” adds Nicolás Juhl, CEO of encentive.

“Energy has become one of the most decisive levers for competitiveness in European industry. It is no longer a background cost but a strategic factor in an era of volatility and sustainable transformation,” said Robin Dechant, Partner at General Catalyst. “encentive turns this pressure point into an opportunity: its AI-driven platform helps industrials cut costs while enabling them to thrive on renewable power. What convinced us was what we believe is the team’s rare ability to bridge cutting-edge AI with the realities of factory floors, a capability that can strengthen Europe’s industrial backbone and accelerate the energy transition.”

Connecting AI to industrial hardware: A billion-euro market

Industry is the world’s largest energy consumer and therefore a decisive lever for achieving a climate-neutral future.The electrification of industrial processes, which is essential for this transition, is further driving up electricity demand. At the same time, the expansion of renewables is making power supply and prices increasingly volatile. In this environment, the ability to actively harness flexibility is becoming a key lever for the future of industry.

Vireo Ventures Closes €50M Electrification Fund I to Empower European Early-stage Founders Orchestrating an All-Electrified World

Vireo Ventures Closes €50M Electrification Fund I to Empower European Early-stage Founders Orchestrating an All-Electrified World

Vireo Ventures, the Berlin-based early-stage venture capital firm, today announced the final closing of its Electrification Fund I at €50 million. In an era defined by resource scarcity and fragile supply chains, the fund underscores investors’ strong desire to invest in solutions that accelerate an all-electrified future that will secure Europe’s energy independence and competitiveness.

Vireo Ventures is backed by six leading European energy utilities, including Encevo, Verbund X, and EnBW New Ventures, as well as the European Investment Fund and NRW.BANK and over 80 seasoned entrepreneurs, sector veterans, and energytech enthusiasts.

From day one, Vireo Ventures has focused on creating a community for the next generation of founders driving Europe’s electrification and energy transition. The team has built a trusted network of industry partners who actively share knowledge, open doors, and pilot new technologies. What began as a small angel investment network among friends and peers has now grown into a dedicated venture fund, closed above target despite one of the toughest fundraising environments. This closing is a clear signal that electrification has become the defining investment theme of this decade.

The closing comes as Europe faces unprecedented pressure to electrify. In 2024, clean electricity supplied 40% of global power. Yet electricity currently accounts for just 23% of the EU’s final energy consumption. To meet climate and energy targets, that share must increase to 35% by 2030 and 61% by 2050. Recent analysis shows that electrifying heating, transport, and industry could halve household energy bills, reduce fossil fuel imports by tens of billions, and strengthen Europe’s strategic autonomy.

Investing in the Electrified Future

With the new fund, Vireo is investing in European early-stage companies that are orchestrating and synchronizing generation, grids, storage, and downstream applications in mobility, industry, and real estate.

“Grid investments are central to Europe’s future security and competitiveness. Europe’s electrification push is not just a climate imperative but a geostrategic necessity,” said Felix Krause, Managing Partner at Vireo Ventures. “Startups are uniquely positioned to deliver the speed, innovation, and scalability needed to meet this challenge.”

A New Model for LP/VC Collaboration in EnergyTech

Vireo Ventures’ approach goes beyond capital. The firm fosters a different kind of relationship, where LPs aren’t just passive investors but collaborators, bringing decades of industry expertise, operational experience, and strategic depth. With investors spanning Europe and the United States, Vireo’s base of utilities, corporates, and entrepreneurs offers startups unique opportunities to test and scale their solutions. Early collaborations have already seen portfolio companies pilot technologies with LPs, from grid intelligence applications to decarbonized heating solutions.

“Our LPs are not just investors. They are experts, allies, and partners,” said Felix Krause. “The majority of our 90+ limited partners have a direct connection to the energy industry. They provide critical insights, help shape due diligence, and often join forces with startups in pilot projects or co-investments. This hands-on collaboration is what sets our model apart and accelerates both commercial success and climate impact.”

„Our focus is on direct investments in start-ups“ explains Crispin Leick, Managing Director EnBW New Ventures. „We have known vireo’s team for a long time and value their experience in the energy and utitlity sector and our shared vision of an all-electrified world. Thanks to Vireo, we are even closer to startup seed investments and their further development. We are already co-investors in FLEXECHARGE.“

“The closing of the Vireo Ventures Fund is a powerful confirmation to the trust the market places in the team and its mission. From day one, our partnership has been shaped by a shared commitment to accelerating the energy transition through innovation. Vireo’s deep expertise, entrepreneurial mindset, and sharp focus on early-stage energy startups in Europe make them an exceptional partner. Their ability to identify and support breakthrough technologies has already created tangible value. We are proud to be part of this journey and look forward to scaling our impact together.”

— Dr. Franz Zöchbauer, Director Corporate Innovation & New Business Managing Director VERBUND Ventures

„We want to strengthen our approach as a partner to our ecosystems and access further opportunities for us and our customers. Whilst we remain primarily focused on direct investments, we have found that Vireo Ventures could be a very good add-on, offering us to access further startups in selected jurisdictions and a complementary focus on seed stage. With a prior co-investment in AmpereCloud, the process was obviously very smooth and straightforward. Looking forward to getting our teams working closely with their startups as well as with the other LPs.”

— Nicolas Milerioux, Head of Venture Capital – Encevo

“In view of the increasing share of renewable energy sources and the volatility of energy production and energy prices, investments in innovative technologies and business models play a crucial role in building a reliable energy system of the future and ensuring affordable prices for all market participants. NRW.Venture’s investment in Vireo Electrification Fund I is therefore dedicated to boosting investment activities and driving the technological transition in North Rhine-Westphalia,”

— Philipp Leidig, Director at NRW.Ventures

“As a proud Limited Partner in the Vireo Electrification Fund, I deeply value the team’s strategic clarity, their strong network across the clean energy ecosystem, and the quality of their portfolio companies. Collaborating with the Vireo team goes beyond capital – it’s an active partnership built on shared conviction and access to some of the most exciting founders in electrification.”

— Dr. Lars Hoffmann, Clean Energy Entrepreneur & Investor

“I have known the Vireo team since early 2021 and have always valued their perspective on the market and how closely they collaborate with their portfolio companies. As co-investors in PIONIX, I’ve already experienced the value they bring, and I’m excited to continue building the electrified future together.”

— Jan Rabe, Co-Founder & CEO, Rabot Energy

Vireo Ventures Early Investments

Since its inception, Vireo has backed startups such as Encentive, Atmen, Green Fusion, and About:Energy, all pioneering scalable solutions in areas like grid optimization, heat decarbonization, and EV infrastructure. Several portfolio companies have already secured follow-on funding, strategic partnerships, or industry awards, strengthening Vireo’s reputation as a high-conviction early-stage investor.

“For us, ESG is embedded in our DNA. Every portfolio company we back contributes directly to decarbonizing critical infrastructure. Their economic success amplifies their impact,” said Matthias Engel, Managing Partner at Vireo Ventures.

Amid geopolitical tensions and volatile fossil fuel prices, digital-first solutions that enhance electrification and resilience are increasingly attractive to investors. Vireo Ventures’ focus on software-enabled, scalable technologies positions the fund to capture this momentum.

Vireo Ventures Fund Closing

FLEXECHARGE Secures €5 Million to Power the Future of Grid-Integrated EV Charging

FLEXECHARGE Secures €5 Million to Power the Future of Grid-Integrated EV Charging

As the adoption of electric vehicles (EVs) accelerates across Europe, the pressure on charging infrastructure grows. Grid volatility and fluctuations in electricity markets are emerging as the most critical bottlenecks for the continent’s transition to electric mobility. Yet, despite this challenge, most commercial charging stations continue to operate as passive, inflexible assets — missing out on the opportunity to support the grid and optimise operational costs.

FLEXECHARGE, a Danish Energy-Tech pioneer, is changing that. The company empowers Charge Point Operators (CPOs) to transform their networks into reliable, grid-integrated, revenue-generating assets, helping them reduce costs by up to 60%. Today, FLEXECHARGE announced a successful €5 million funding round, led by Eneco Ventures and EnBW New Ventures. The round also saw participation from Greencode Ventures and us at Vireo Ventures.

Building the Infrastructure for Smart Charging

The FLEXECHARGE team — Max Brandt, Jan Köster, and Robert Brehm — has developed a comprehensive infrastructure stack designed to help CPOs thrive in the energy transition. Their key solutions include:

-

HARMON-E: A vendor-independent load and energy management platform that allows operators to intelligently control energy flows.

-

GATEWAY: An on-site controller that ensures local reliability and resilience at charging locations.

-

Aggregate: A virtual power plant module that enables participation in flexibility markets, creating new revenue streams.

Already, FLEXECHARGE technology powers over 95 MW of EV charging capacity across Europe, with leading operators such as Electra and Bump relying on their solutions.

Driving the Transition to Resilient, Future-Ready Networks

Max Brandt, CEO of FLEXECHARGE, summarises the company’s mission:

“We want to become the leading provider of load, energy, and grid management — empowering commercial charging operators to reduce costs and build resilient, future-ready networks.”

At Vireo Ventures, we are proud to support FLEXECHARGE in building exactly the kind of solution Europe needs to accelerate the electric mobility transition.

We extend our congratulations to the entire FLEXECHARGE team — Max, Jan, Robert — and thank our co-investors Ashley Klapwijk, Pascal Beckers-Jaleta, Dr. Terhi (TJ) Vapola, Manuel Heckmann, Christian Rangen, Stine Rolstad Brenna, Crispin Leick, Christophe Lephilibert, and many others who made this milestone possible.

For further details, see the official announcement on electrive.net.

Atmen Secures €5M Seed Round to Power Europe’s Industrial Resilience Through Data-Driven Certification

Atmen Secures €5M Seed Round to Power Europe’s Industrial Resilience Through Data-Driven Certification

The funding will expand Atmen’s platform, helping industrial producers certify product origins and ensure supply chain integrity.

Munich, Germany – May 03, 2025 – Atmen (atmen.co), the company automating sustainability certification for industry, today announced a €5M seed funding round, led by Project A. Existing investors Revent and Vireo Ventures also participated, alongside notable angel investors including former TÜV SUD CEO Axel Stepken, Former CEO and serial Board member in tech environments including ThyssenKrupp, Martina Merz, and serial founder Christian Vollmann, an early investor in Trivago and SumUp. This brings Atmen’s total funding to €6.3M.

In an era of fierce global competition, European industrial companies face a dual challenge: creating a market advantage through sustainability leadership while ensuring global competitiveness.

The critical need for Atmen’s solution becomes clear when examining Europe’s fertiliser supply chain. Ammonia, an essential component for food security across the continent, is a prime example. While the EU imported approximately 25% of its fertilisers from Russia in 2024, valued at over €2.2 billion, the transition to low-carbon ammonia faces a fundamental verification challenge. Since a molecule of ammonia looks identical regardless of production method, this transition requires robust certification systems that can process over 70,000 data points annually to verify product origins and environmental credentials. This is precisely where Atmen comes in.

While traditional approaches rely on periodic sampling and yearly estimates, Atmen’s platform ingests granular, real-time operational data directly from industrial processes. This integration into industrial workflows streamlines compliance for energy-intensive products like hydrogen and renewable fuels, enabling companies to prove product composition and material origins with unprecedented certainty. By digitising certification processes, Atmen enhances traceability while reducing complexity, a crucial advantage for European industry navigating the energy transition.

Industry expertise drives practical solutions

Atmen was founded in January 2023 by Flore de Durfort, Quentin Cangelosi, and Erika Degoute, who met working at the renowned energy company E.ON. They identified a critical problem: despite its growing importance for market access, product certification still relied on outdated, manual processes – error-prone paperwork and scattered spreadsheets that couldn’t handle today’s complex supply chains and data requirements.

The team combines energy market expertise with robust technical capabilities. Atmen’s flagship product, ‚Automate,‘ is already in use across industrial sites in 9 countries and working with five leading certification bodies, including TÜV NORD.

Building European competitiveness in a changing world

As Europe navigates complex trade tensions with the US, energy dependency on Russia, and manufacturing competition from China, traditional certification methods are failing due to their paper-based, labour-intensive processes. Cross-border transactions now require detailed certification of product origins and sustainability credentials, overwhelming systems designed for simpler supply networks. Atmen connects everyone involved, from producers and traders to auditors and certification labels, in a single system. This replaces scattered spreadsheets and siloed audits with continuous data monitoring and tracking tools that validate each product’s specifications and origins. Atmen’s approach also aligns with the EU Clean Industrial Deal, which outlines concrete actions to turn decarbonisation into a driver of growth for European industries.

With this €5 million funding, Atmen plans to expand beyond hydrogen, renewable and low-carbon fuels to certify a wider range of energy-intensive goods, including steel, chemicals, and fertilisers – sectors where proving product characteristics is essential for market access and decarbonisation. The team will also strengthen connections with regulators and certification schemes while launching tools that help companies track environmental impact and meet evolving regulations, which are increasing scrutiny on product sustainability claims.

Strengthening industry through transparency

As supply chains face growing pressure from geopolitical shifts and energy transitions, reliable product certification becomes essential for European businesses. Atmen’s platform builds trust in product claims by raising the standard from periodic sampling to comprehensive data analysis – all while simplifying the process for manufacturers.

The platform helps companies navigate certification requirements, optimising their supply chains for both compliance and commercial goals. Atmen achieves this through advanced modelling tools that clarify decision-making and provide supply chain visibility.

Atmen is already working with industry leaders, including Lhyfe, Schneider Electric, and Energy & Regulation Partners. The team, currently at 11 employees, will expand to support the company’s ambitious growth trajectory.

„European industries need reliable ways to verify products across borders and supply chains,“ says Flore de Durfort, CEO and co-founder of Atmen. „We’re simplifying and scaling product certification, turning a traditional bottleneck into a competitive advantage. Our platform acts as a data infrastructure layer on top of industrial supply chains, processing complete operational datasets while reducing complexity. With Europe’s limited access to fossil fuels, the transition to renewable energy requires stronger systems to verify clean energy products – that’s precisely what we’re building.”

„In a world where industrial competitiveness depends on traceable, low-carbon supply chains, Atmen is building the digital backbone that turns complex production inputs into compliant, market- and export-ready products,“ says Mila Cramer, Principal at Project A.

Atmen closes financing round

Congratulations to our portfolio company Metiundo on securing €5 million in project financing from Berliner Volksbank!

This milestone supports metiundo’s mission to accelerate the rollout of smart submetering solutions for the housing industry – empowering property owners and tenants alike to manage energy more transparently and efficiently.

We’re proud to back the team on their journey to digitize energy infrastructure in multi-tenant buildings.

➡️ Full article via PV Magazine (in German).

Vireo Insider - May 2025

Dear Ladies and Gentlemen,

We’re getting close to the finish line – our fund will officially close to new investors at the end of June.

It’s been an exciting ride: strong momentum, a growing community of LPs, and real alignment around our mission. If you’ve been thinking about joining us, now’s the time.

At Vireo Ventures, we back ambitious founders driving the energy transition – but just as importantly, we’re building a network around them. Our LPs aren’t just names on a report. They’re experts, allies, and collaborators who share insights, challenge assumptions, and open doors.

Today, we’re proud to count nearly 70 energy-focused investors – private individuals, family offices, and corporates from across Europe – all united by a belief in the potential of an all-electrified world. This partnership model doesn’t just benefit the fund, it strengthens the ecosystem and improves the odds for early-stage companies navigating complex markets.

Our partner Felix recently wrote about this shift – how LPs and GPs are redefining what real collaboration looks like in venture, and how that’s reshaping the future of European energy tech. (We’ll share the full article in our next issue.)

That’s the kind of platform we’re building. And if that resonates, we’d love to talk.

🔋 Back from Intersolar Europe

We saw that spirit of collaboration in full force last week at Intersolar in Munich – and the energy sector is absolutely buzzing.

Between reconnecting with LPs like VERBUND and EnBW New Ventures, meeting new faces, and catching up with founders across the value chain, one thing was clear: this market is moving fast.

Over the course of three intense (and fun) days, we hosted around 60 startup pitches, a few logistics hiccups here and there, but overall a fantastic turnout and great momentum.

⚡ The Grid Returns

In parallel, we hosted the second edition of The Grid – our flagship side event, co-hosted with BRYCK.COM, World Fund, and HTGF | High-Tech Gründerfonds, and supported by rEnergy Partners, Enpulse , VERBUND, Shell Ventures, and VentureCapital Magazin.

More than 180+ people showed-up, and the energy in the room was electric. Huge thanks to everyone who made it happen.

🗞 In the Press

We were included in Sifted’s Q1 2025 ranking of the most active and influential VC and CVC investors in European tech. Always good to see energy tech getting the spotlight it deserves.

🗣️ On Stage & On Mic

🎤 Felix joined an ENERPARC AG at Intersolar to talk about what early-stage energy-tech startups really need to succeed.

🎙️ He also joined Somil from CleanTechies to talk about leadership lessons, the kind that come from the tougher parts of the journey. 🎧 Listen to the episode

🎤 Meanwhile, Matthias joined a panel at the Better Future Conference (Axel Springer) to discuss energy transition, industrial competitiveness, and the policy frameworks needed to get there.

🗓 Where to Find Us Next

- 15–16 May – HackSummit, Lausanne

- 19–20 May – HTGF Family Day, Berlin

- 22 May – VC Central, Poland

- 3–4 June – EcoSummit, Berlin

💼 Who’s Hiring?

A few of our portfolio companies are growing fast and looking for great people:

- Flexecharge → Job board

- Reshape Energy → LinkedIn Jobs

Know someone looking for their next challenge in energy-tech? Pass it along.

That’s it from us for now. If you’re building, investing, or simply exploring what’s happening in early-stage energy tech – we’d love to hear from you.

Interested in the fund or what it’s like to be part of the Vireo LP community? We’re always happy to have a conversation.

All the best, Felix, Lou, Matthias, Mischa, Sandro, Sven & Thomas

Reshape Energy Secures €5M to Offer Electrification and Energy Optimization as a Service to Commercial Building Owners across Europe

Reshape Energy GmbH, a Munich-based building energy services business, has successfully raised €5 million in expansion capital. The funding was provided by the founding team, industry insiders, PostScriptum Ventures and Vireo Ventures, a European early-stage venture capital fund focused on electrification and digitalization. This funding round will enable Reshape Energy to complete additional acquisitions across the building energy services value chain in Germany, enhance its technology platform capabilities to drive operational efficiency and maintain high quality standards, and scale its commercial offering to capture market demand.

Reshape Energy is addressing a multi-billion-euro opportunity fueled by rising energy costs and increasing regulatory pressure on property owners across Europe. Targeting owners of property portfolios, the company simplifies the transformation of building energy performance with an all-in-one solution. By integrating assessment, planning, financing, implementation, and ongoing management and optimization, its platform enables property owners and their tenants to reduce costs, enhance property values, and achieve sustainability targets. The founding team, consisting of Alan Clifford, Andrew Goodwin, Andrew Mack, Gerard Reid, Benjamin Stanzl and Markus Wiendieck, brings extensive experience in the energy sector, having previously launched and scaled successful ventures such as the Germany business of Octopus Energy – now the UK’s largest energy retailer – and Verivox, one of Germany’s largest energy price comparison platforms. “Today’s building energy services market is fragmented and inefficient. Property owners are forced to deal with a patchwork of providers, manual processes, and limited access to financing – making energy optimization complex and costly. Our strategy is centered on acquiring and integrating businesses across the building energy services value chain to offer a one-stop-shop solution to our customers,” said Andrew Mack, CEO of Reshape Energy. “By equipping these businesses with state of the art digitalization tools, streamlined processes, access to capital, and strategic direction, we are creating a new category of energy services company that can deliver unparalleled value to property owners.” Buildings consume 35% of Germany’s energy and generate 30-40% of its CO₂ emissions, making them the EU’s largest energy consumer. Ineffi ciencies caused by outdated systems and rising energy prices are becoming an increasing challenge for German and European companies and property owners. Reshape Energy is initially focused on the German market, where it completed

the acquisitions of an energy consulting business and a commercial solar planning, installation and maintenance company. The company plans to expand its footprint across Europe in the coming years. “Reshape Energy has adopted an innovative approach to providing building energy services, and we are excited to support the company’s continued growth,” said Mischa Wetzel, Partner at Vireo Ventures. “Their deep industry expertise and commitment to sustainability align perfectly with our investment strategy. We look forward to seeing the company achieve its ambitious goals and make a significant contribution to the energy transition.”

„For further info see this article on Techcrunch“:

https://techcrunch.com/2025/03/11/reshape-energy-is-using-an-acquisition-playbook-to-drive-energy-upgrades-for-commercial-real-estate/

WiWo Interview on DSB’s Business Model and Funding Round led by Vireo Ventures (Article in German Only)

Handwerker aus der Region, konservativer Auftritt: Wie drei Ex-Enpal-Mitarbeiter mit einem Energie-Start-up Eigenheimbesitzer bei der Modernisierung helfen wollen.

Ein Land, in dem jedes Einfamilienhaus nachhaltig modernisiert ist, ohne Stress für die Eigentümer: Mit dieser Vision gehen die drei Gründer Sebastian Schmidt, Niclas Kern und Adam Khenissi an den Start. Ihr Start-up „Deutsche Sanierungsberatung“, gegründet im vergangenen Jahr, soll Eigenheimbesitzern helfen, ihre Immobilie zu sanieren, von der Dämmung bis zum Solardach. „Wir sind dein zentraler Partner, wenn es darum geht, Strom- und Wärmekosten im Eigenheim zu senken“, sagt CEO Schmidt.

Für diese Mission hat das junge Unternehmen jetzt eine Finanzierung erhalten: 3,6 Millionen Euro haben die Gründer aus Berlin eingesammelt. Die führenden Investoren sind der Berliner Energietechnologie-Investor Vireo Ventures und, ebenfalls aus Berlin, IBB Ventures, bekannt etwa für Investments in den Heizungsbauer Thermondo und die Sprachlernplattform Babbel. Die Finanzierung soll dem Start-up helfen, seine digitale Planungstechnik auszubauen und schnell zu wachsen.

Das Geschäft haben die Gründer beim Energie-Einhorn Enpal kennengelernt. Bei dem Berliner Dienstleister, der mit dem Bau von Solaranlagen auf Hausdächern groß geworden ist, haben Schmidt, Kern und Khenissi die Sparte „Dragon“ aufgebaut.

Mit der möchte sich Enpal das Geschäft mit der Installation von Wärmepumpen erschließen.

Mit seinem eigenen Start-up macht das Trio nun seinem Ex-Arbeitgeber Konkurrenz. Doch während Enpal selbst als Installateur etwa von Solaranlagen auftritt, soll das Start-up eher die Rolle eines Energieberaters übernehmen. „Wir sehen uns als neutralen Partner von Hausbesitzern, die sie gezielt darüber aufklärt, welche Sanierungsmaßnahmen am besten geeignet sind“, sagt Mitgründer Kern.

„Deutsche Sanierungsberatung“: Schon der eher konservative Name des Start-ups soll Vertrauen schaffen – schließlich geht es bei Haussanierungen um größere Investitionen. Wer sich an das Start-up wendet, erhält erst einmal Besuch von einem Architekten oder Bauingenieur, der das Gebäude genau unter die Lupe nimmt.

Welche Sanierung rechnet sich?

Ist die Hauselektrik überhaupt geeignet, um eine Solaranlage zu installieren, oder müssen teuer neue Kabel verlegt werden? Sind die Sparren im Dach stark genug für eine neue Dämmung oder müssen sie ausgetauscht werden? Passt die Form der Dachziegel, um Solarmodule zu installieren?

Die Informationen fließen in der Zentrale des Start-ups in ein digitales Ebenbild des Hauses. Dort berechnen die Experten dann, welche Sanierung sich rechnet – von der Dämmung über den Fenstertausch bis zur wieder stark gefragten Wärmepumpe und Solaranlage. „Wir können unseren Kunden dann passgenaue Angebote von lokalen Handwerksbetrieben unterbreiten“, sagt Gründer Schmidt.

Der digitale Service soll Eigenheimbesitzern schnell ein Sanierungskonzept bieten und Handwerkern den Planungsaufwand sparen. Die Bauarbeiten sollen dann aber weiterhin lokale Handwerker übernehmen – die räumliche Nähe erlaube eine viel persönlichere Dienstleistung, sind die Gründer überzeugt. Künftig wollen die Gründer auch digitale Vernetzung etwa von Solaranlagen und E-Autos sowie smarte Stromtarife bei ihren Kunden vermarkten.

Rund 50 Mitarbeiter hat die „Deutsche Sanierungsberatung“ inzwischen. Nach der erfolgreichen Finanzierungsrunde wollen die Berliner Gründer dieses Jahr deutlich wachsen. Im vergangenen Jahr machte das Start-up knapp zwei Millionen Euro Umsatz. Unter anderem 42watt aus München und Enter aus Berlin positionieren sich mit einem ähnlichen Konzept am Markt. Der aber sei groß genug, sagt Gründer Schmidt. Bisher verursacht der Gebäudebereich 30 Prozent der CO2-Emissionen in Deutschland. Damit die auf Null sinken, müssen noch viele Milliarden Euro investiert werden.