Delta Charge secures $4.3m to electrify European logistics and industry

Munich, 20 November 2025 — Delta Charge, a Swedish-German company that is pioneering charging and battery storage solutions for electric trucks, has raised $4.3m equity in an oversubscribed funding round led by Vireo Ventures and Rethink Ventures. The round includes executives from Audi and Allianz, German family offices and founders of Munich’s climate tech ecosystem. The funds will accelerate the growth of Delta Charge’s pan-European network of truck-charging depots and battery-enabled industrial hubs.

Founded in 2024 in Munich, Delta Charge combines battery energy storage systems (BESS) and charging hardware, energy management, and fixed-price charging services to enable European logistics and industry to unlock the economic advantages of large-scale energy operations. Backed by Delta Capacity, one of Scandinavia’s leading battery storage developers and investors, Delta Charge aims to deploy more than €300 million in infrastructure and deliver 1.8 TWh annually of clean energy by 2030.

“This financing marks a defining moment for Delta Charge as we scale our platform and continue to execute our vision,” said Filip Hes, CEO of Delta Charge. “We are seizing a once-in-a-decade opportunity to serve historic load growth and shape a new infrastructure asset class at the heart of Europe’s energy transition. With Rethink’s ambition to redefine transportation and Vireo’s strong commitment to European electrification, as well as Delta Capacity’s experience executing large scale battery projects, we are uniquely positioned to accelerate deployment across our pipeline.”

The announcement comes at a time when heavy-duty electrification is driving unprecedented load growth that could soon rival or even exceed the electricity consumption of Europe’s data centers. As transport could account for almost 50% of the continent’s CO2 emissions by 2030, logistics and freight operations present one of the largest untapped opportunities to substantially cut emissions while reducing per-kilometre costs.

“Operating electric truck fleets at the lowest possible total cost of ownership will rely on smart depot charging solutions that combine battery storage, charging infrastructure, and seamless software integration,” added Jens Philipp Klein, General Partner at Rethink Ventures. “The team at Delta Charge brings deep expertise across energy infrastructure execution, advanced battery software, and a track record of raising hundreds of millions towards rapidly scaling and executing infrastructure pipelines.”

With grid capacity tightening and permitting slowing, depot-based charging and battery storage are projected to attract more than €7 billion in investment by 2030. Positioned at the intersection of logistics and energy flexibility, Delta Charge aims to anchor the infrastructure powering Europe’s zero-carbon freight future.

About Delta Charge

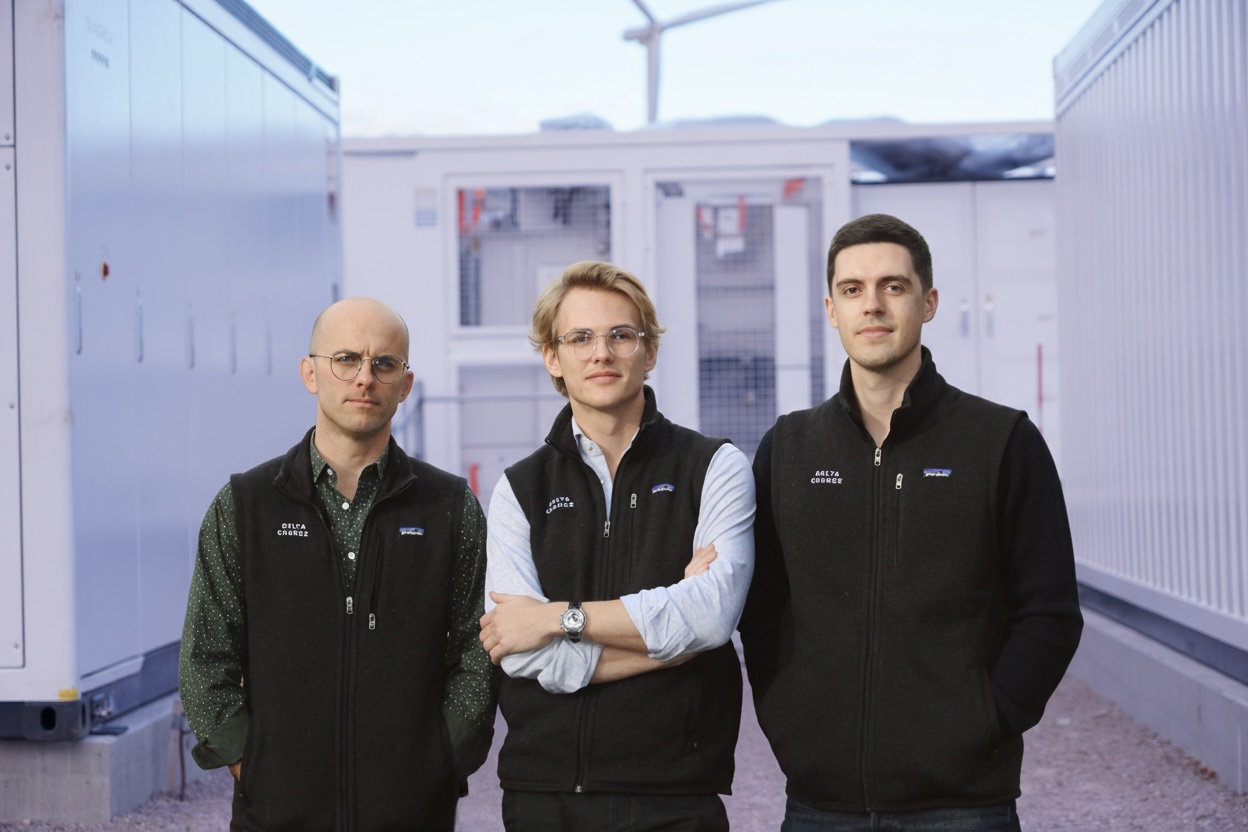

Founded in 2024 by Filip Hes, Johannes Kirnberger and Connor Hanafee, Delta Charge is a Swedish-German energy infrastructure company pioneering end-to-end charging and battery storage solutions for Europe’s freight sector. The company develops and finances a pan-European network of truck-charging depots and battery-enabled industrial hubs. Its platform combines intelligent software, grid-connected batteries, and fixed-price charging services to help fleet operators electrify their operations while supporting a more flexible and resilient power grid.

Backed by Delta Capacity, one of Scandinavia’s leading battery energy storage developers, Delta Charge is led by a founding team with deep expertise across energy infrastructure, advanced battery software, and large-scale project financing. The company aims to deploy over €300 million in infrastructure and deliver 1.8 TWh of clean energy annually by 2030, anchoring the backbone of Europe’s zero-carbon freight future.

Pionix secures more than €8M to unify global EV charging with open-source technology

Pionix raises over €8 million to scale EV charging enterprise products on the open-source EVerest stack, hosted by Linux Foundation Energy (LF Energy), which allows the industry to build on a shared software foundation.

The open-source approach accelerates innovation while dramatically improving reliability, interoperability and long-term maintainability across the global EV charging ecosystem, which currently sees failed charging session rates of up to 25%.

The EVerest stack is considered a highly impactful open-source initiative within the cleantech space, with an estimated ecosystem value of more than $500 million.

Karlsruhe, GERMANY – 18 November 2025

The German e-mobility tech startup, Pionix, has raised over €8 million to scale its open-source-powered products for the global e-mobility industry. Built on the EVerest stack, Pionix offers a suite of engineering and enterprise services to unify EV charging technology under a common framework. The late seed round was led by Ascend Capital Partners, with participation from Start-up BW Seed Fonds, managed by MBG Baden-Württemberg, Pale blue dot, Vireo Ventures, Axeleo Ventures and further investors.

Despite rapid development across e-mobility in recent years, EV charging remains fragmented. The industry’s growing ecosystem of hardware and software companies operates proprietary, closed software systems that often fail to communicate seamlessly with one another. Failures in interoperability and communication have led to reliability issues, inefficient maintenance of infrastructure and charging session error rates of up to 25%.

Founded in 2021, Pionix’s products offer a shared software foundation for all EV charging technologies, ensuring reliability, interoperability and future-readiness of global infrastructure. In response to the industry’s challenges, Pionix initiated and contributed significantly to EVerest, an open-source software platform. EVerest serves as a common foundation for charger manufacturers, charging operators, automakers and fleets to build on, eliminating compatibility issues and enabling faster innovation across the EV charging ecosystem.

Today, EVerest has grown into one of the most impactful open-source initiatives in cleantech and with support from 600 contributors from more than 70 organizations and powers hundreds of thousands of chargers globally.

The open-source software, donated by Pionix in 2021 to Linux Foundation Energy (LF Energy), has an estimated ecosystem value of more than $500 million – already almost half of the estimated ecosystem value of the Linux kernel, which is considered the world’s most renowned open-source project at roughly $1.2 billion.

Vireo Insider - May 2025

Dear Ladies and Gentlemen,

We’re getting close to the finish line – our fund will officially close to new investors at the end of June.

It’s been an exciting ride: strong momentum, a growing community of LPs, and real alignment around our mission. If you’ve been thinking about joining us, now’s the time.

At Vireo Ventures, we back ambitious founders driving the energy transition – but just as importantly, we’re building a network around them. Our LPs aren’t just names on a report. They’re experts, allies, and collaborators who share insights, challenge assumptions, and open doors.

Today, we’re proud to count nearly 70 energy-focused investors – private individuals, family offices, and corporates from across Europe – all united by a belief in the potential of an all-electrified world. This partnership model doesn’t just benefit the fund, it strengthens the ecosystem and improves the odds for early-stage companies navigating complex markets.

Our partner Felix recently wrote about this shift – how LPs and GPs are redefining what real collaboration looks like in venture, and how that’s reshaping the future of European energy tech. (We’ll share the full article in our next issue.)

That’s the kind of platform we’re building. And if that resonates, we’d love to talk.

🔋 Back from Intersolar Europe

We saw that spirit of collaboration in full force last week at Intersolar in Munich – and the energy sector is absolutely buzzing.

Between reconnecting with LPs like VERBUND and EnBW New Ventures, meeting new faces, and catching up with founders across the value chain, one thing was clear: this market is moving fast.

Over the course of three intense (and fun) days, we hosted around 60 startup pitches, a few logistics hiccups here and there, but overall a fantastic turnout and great momentum.

⚡ The Grid Returns

In parallel, we hosted the second edition of The Grid – our flagship side event, co-hosted with BRYCK.COM, World Fund, and HTGF | High-Tech Gründerfonds, and supported by rEnergy Partners, Enpulse , VERBUND, Shell Ventures, and VentureCapital Magazin.

More than 180+ people showed-up, and the energy in the room was electric. Huge thanks to everyone who made it happen.

🗞 In the Press

We were included in Sifted’s Q1 2025 ranking of the most active and influential VC and CVC investors in European tech. Always good to see energy tech getting the spotlight it deserves.

🗣️ On Stage & On Mic

🎤 Felix joined an ENERPARC AG at Intersolar to talk about what early-stage energy-tech startups really need to succeed.

🎙️ He also joined Somil from CleanTechies to talk about leadership lessons, the kind that come from the tougher parts of the journey. 🎧 Listen to the episode

🎤 Meanwhile, Matthias joined a panel at the Better Future Conference (Axel Springer) to discuss energy transition, industrial competitiveness, and the policy frameworks needed to get there.

🗓 Where to Find Us Next

- 15–16 May – HackSummit, Lausanne

- 19–20 May – HTGF Family Day, Berlin

- 22 May – VC Central, Poland

- 3–4 June – EcoSummit, Berlin

💼 Who’s Hiring?

A few of our portfolio companies are growing fast and looking for great people:

- Flexecharge → Job board

- Reshape Energy → LinkedIn Jobs

Know someone looking for their next challenge in energy-tech? Pass it along.

That’s it from us for now. If you’re building, investing, or simply exploring what’s happening in early-stage energy tech – we’d love to hear from you.

Interested in the fund or what it’s like to be part of the Vireo LP community? We’re always happy to have a conversation.

All the best, Felix, Lou, Matthias, Mischa, Sandro, Sven & Thomas

Reshape Energy Secures €5M to Offer Electrification and Energy Optimization as a Service to Commercial Building Owners across Europe

Reshape Energy GmbH, a Munich-based building energy services business, has successfully raised €5 million in expansion capital. The funding was provided by the founding team, industry insiders, PostScriptum Ventures and Vireo Ventures, a European early-stage venture capital fund focused on electrification and digitalization. This funding round will enable Reshape Energy to complete additional acquisitions across the building energy services value chain in Germany, enhance its technology platform capabilities to drive operational efficiency and maintain high quality standards, and scale its commercial offering to capture market demand.

Reshape Energy is addressing a multi-billion-euro opportunity fueled by rising energy costs and increasing regulatory pressure on property owners across Europe. Targeting owners of property portfolios, the company simplifies the transformation of building energy performance with an all-in-one solution. By integrating assessment, planning, financing, implementation, and ongoing management and optimization, its platform enables property owners and their tenants to reduce costs, enhance property values, and achieve sustainability targets. The founding team, consisting of Alan Clifford, Andrew Goodwin, Andrew Mack, Gerard Reid, Benjamin Stanzl and Markus Wiendieck, brings extensive experience in the energy sector, having previously launched and scaled successful ventures such as the Germany business of Octopus Energy – now the UK’s largest energy retailer – and Verivox, one of Germany’s largest energy price comparison platforms. “Today’s building energy services market is fragmented and inefficient. Property owners are forced to deal with a patchwork of providers, manual processes, and limited access to financing – making energy optimization complex and costly. Our strategy is centered on acquiring and integrating businesses across the building energy services value chain to offer a one-stop-shop solution to our customers,” said Andrew Mack, CEO of Reshape Energy. “By equipping these businesses with state of the art digitalization tools, streamlined processes, access to capital, and strategic direction, we are creating a new category of energy services company that can deliver unparalleled value to property owners.” Buildings consume 35% of Germany’s energy and generate 30-40% of its CO₂ emissions, making them the EU’s largest energy consumer. Ineffi ciencies caused by outdated systems and rising energy prices are becoming an increasing challenge for German and European companies and property owners. Reshape Energy is initially focused on the German market, where it completed

the acquisitions of an energy consulting business and a commercial solar planning, installation and maintenance company. The company plans to expand its footprint across Europe in the coming years. “Reshape Energy has adopted an innovative approach to providing building energy services, and we are excited to support the company’s continued growth,” said Mischa Wetzel, Partner at Vireo Ventures. “Their deep industry expertise and commitment to sustainability align perfectly with our investment strategy. We look forward to seeing the company achieve its ambitious goals and make a significant contribution to the energy transition.”

„For further info see this article on Techcrunch“:

https://techcrunch.com/2025/03/11/reshape-energy-is-using-an-acquisition-playbook-to-drive-energy-upgrades-for-commercial-real-estate/

WiWo Interview on DSB’s Business Model and Funding Round led by Vireo Ventures (Article in German Only)

Handwerker aus der Region, konservativer Auftritt: Wie drei Ex-Enpal-Mitarbeiter mit einem Energie-Start-up Eigenheimbesitzer bei der Modernisierung helfen wollen.

Ein Land, in dem jedes Einfamilienhaus nachhaltig modernisiert ist, ohne Stress für die Eigentümer: Mit dieser Vision gehen die drei Gründer Sebastian Schmidt, Niclas Kern und Adam Khenissi an den Start. Ihr Start-up „Deutsche Sanierungsberatung“, gegründet im vergangenen Jahr, soll Eigenheimbesitzern helfen, ihre Immobilie zu sanieren, von der Dämmung bis zum Solardach. „Wir sind dein zentraler Partner, wenn es darum geht, Strom- und Wärmekosten im Eigenheim zu senken“, sagt CEO Schmidt.

Für diese Mission hat das junge Unternehmen jetzt eine Finanzierung erhalten: 3,6 Millionen Euro haben die Gründer aus Berlin eingesammelt. Die führenden Investoren sind der Berliner Energietechnologie-Investor Vireo Ventures und, ebenfalls aus Berlin, IBB Ventures, bekannt etwa für Investments in den Heizungsbauer Thermondo und die Sprachlernplattform Babbel. Die Finanzierung soll dem Start-up helfen, seine digitale Planungstechnik auszubauen und schnell zu wachsen.

Das Geschäft haben die Gründer beim Energie-Einhorn Enpal kennengelernt. Bei dem Berliner Dienstleister, der mit dem Bau von Solaranlagen auf Hausdächern groß geworden ist, haben Schmidt, Kern und Khenissi die Sparte „Dragon“ aufgebaut.

Mit der möchte sich Enpal das Geschäft mit der Installation von Wärmepumpen erschließen.

Mit seinem eigenen Start-up macht das Trio nun seinem Ex-Arbeitgeber Konkurrenz. Doch während Enpal selbst als Installateur etwa von Solaranlagen auftritt, soll das Start-up eher die Rolle eines Energieberaters übernehmen. „Wir sehen uns als neutralen Partner von Hausbesitzern, die sie gezielt darüber aufklärt, welche Sanierungsmaßnahmen am besten geeignet sind“, sagt Mitgründer Kern.

„Deutsche Sanierungsberatung“: Schon der eher konservative Name des Start-ups soll Vertrauen schaffen – schließlich geht es bei Haussanierungen um größere Investitionen. Wer sich an das Start-up wendet, erhält erst einmal Besuch von einem Architekten oder Bauingenieur, der das Gebäude genau unter die Lupe nimmt.

Welche Sanierung rechnet sich?

Ist die Hauselektrik überhaupt geeignet, um eine Solaranlage zu installieren, oder müssen teuer neue Kabel verlegt werden? Sind die Sparren im Dach stark genug für eine neue Dämmung oder müssen sie ausgetauscht werden? Passt die Form der Dachziegel, um Solarmodule zu installieren?

Die Informationen fließen in der Zentrale des Start-ups in ein digitales Ebenbild des Hauses. Dort berechnen die Experten dann, welche Sanierung sich rechnet – von der Dämmung über den Fenstertausch bis zur wieder stark gefragten Wärmepumpe und Solaranlage. „Wir können unseren Kunden dann passgenaue Angebote von lokalen Handwerksbetrieben unterbreiten“, sagt Gründer Schmidt.

Der digitale Service soll Eigenheimbesitzern schnell ein Sanierungskonzept bieten und Handwerkern den Planungsaufwand sparen. Die Bauarbeiten sollen dann aber weiterhin lokale Handwerker übernehmen – die räumliche Nähe erlaube eine viel persönlichere Dienstleistung, sind die Gründer überzeugt. Künftig wollen die Gründer auch digitale Vernetzung etwa von Solaranlagen und E-Autos sowie smarte Stromtarife bei ihren Kunden vermarkten.

Rund 50 Mitarbeiter hat die „Deutsche Sanierungsberatung“ inzwischen. Nach der erfolgreichen Finanzierungsrunde wollen die Berliner Gründer dieses Jahr deutlich wachsen. Im vergangenen Jahr machte das Start-up knapp zwei Millionen Euro Umsatz. Unter anderem 42watt aus München und Enter aus Berlin positionieren sich mit einem ähnlichen Konzept am Markt. Der aber sei groß genug, sagt Gründer Schmidt. Bisher verursacht der Gebäudebereich 30 Prozent der CO2-Emissionen in Deutschland. Damit die auf Null sinken, müssen noch viele Milliarden Euro investiert werden.

Scale Energy secures seed financing to build the largest decentralized battery storage network in europe

The €2 million equity investment into the company is led by Climentum Capital with participation from Vireo Ventures and others.

Scale Energy is quickly becoming the market leader in industrial battery storage development and has secured a battery project CapEx committment for 100 MW from an energy focused infrastructure investor.

Berlin, Germany: 20 February 2025 – Scale Energy, Germany’s leading developer of industrial battery storage systems, has successfully closed an oversubscribed Seed funding round.

The equity funding is led by Climentum Capital, a European early-stage climate tech investor, with participation from Vireo Ventures as well as existing shareholders Antler and P3A. The funding will further enable Scale Energy to increase its operational footprint across Germany and accelerate the deployment of industrial battery projects.

A number of high-profile angel investors with deep industry expertise also joined the financing round, including Dr. Christine Prauschke, former Chief Digital Officer at Enpal and CEO at leadity, Henning Gebhardt, former Global Head of Equities at DWS, and Thomas Rüschen, former Deutsche Bank senior executive. Further industrial expertise comes from Frankfurt based family office SKR Capital.

Battery projects will be financed through a CapEx facility provided by a DACH based energy-focused infrastructure investor with a commitment for 100 MW.

Scale Energy is building Europe’s largest decentralized network of energy storage. Instead of building expensive greenfield storage infrastructure, Scale Energy uses existing, often underutilized grid connections to store energy in batteries and balance the power grid. Additionally, by using the storage to shift electricity consumption from high- to low-price time windows and reduce their grid fees via peak shaving, industrials enhance their energy security, lower CO₂ emissions, and meet their sustainability targets.

At a time when Europe is facing the twin challenges of rising energy costs and transitioning to renewable energy, this solution has never been more important. Energy prices in Europe are now between two to three times higher than in the US. Frontier Economics estimates that battery storage could save €12bn in electricity trading costs by 2050, while Scale Energy predicts that its solution could save German industry more than €9bn per year.

Scale Energy has already developed a project pipeline of more than half a gigawatt at more than 100 industrial sites, mainly in Germany and Austria. Existing customers of Scale Energy include paper producers, automotive suppliers and aluminum manufacturers. Any organization that has access to a grid connection of more than 1,000 Kilowatts can benefit from Scale Energy’s services.

The three founders Christoph Koessler, Nikolas Fendel and Elias Aruna combine expertise in energy operations, infrastructure financing, and engineering. Elias Aruna, CEO, comments: “At Scale Energy, our mission is to support industrials in redefining their energy use. We deliver solutions that reduce energy costs, stabilize the grid, and drive decarbonization.”

Dörte Hirschberg, General Partner at Climentum Capital, adds: “Scale Energy is not only unlocking an immense problem in the energy transition, but the team is also solving financial scaling challenges. Few companies manage early on to bundle venture and infrastructure CapEx financing into a convincing structure that enables attractive offerings for industrial customers.”

VERBUND X Ventures joins Vireo Ventures as a strategic LP

Welcome VERBUND X!

The Corporate VC arm of Austria’s leading energy group VERBUND, VERBUND X shares our vision for innovation and electrification as key drivers of building the future energy system.

With VERBUND X on board, Vireo now partners with four major European utility companies — a clear sign of trust in our mission and recognition of the role venture capital plays in advancing the energy transition.

Franz Zöchbauer, Managing Director of VERBUND X, captures the alignment perfectly:

“Vireo’s focus on early-stage energy tech startups in Europe fits seamlessly with our strategy. Their experienced team, with a strong track record, opens the door to top-tier deal flow while creating valuable synergies through shared expertise and co-investment opportunities. Together, we can identify and scale innovative technologies to make a meaningful impact on the energy transition.”

VERBUND X now joins our network of strategic partners, which include, among others, the European Investment Fund (EIF) and EnBW New Ventures.

We’re proud to have such strong supporters by our side, all united by the same mission: driving the energy transition forward.

Thank you for your trust and collaboration: Michael Strugl, Franz Zöchbauer, Tanja Reiter and the entire team at VERBUND X.

Announcing the 12 Winners of Our Call for Start-ups at E-world 2025

We are pleased to announce the 12 innovative start-ups selected to pitch at the E-world energy & water 2025 in Essen.

This year’s application process was highly competitive, with over 60 companies from 13 countries applying. The calibre of ideas was exceptional, and selecting the final participants was more challenging than ever.

Here are the 12 winners driving innovation in decarbonising urban spaces:

- Podero

- Gridcog

- Pleevi

- VEIR

- BitWatt Systems

- j4energy

- Optimeering

- encentive

- Blindleister

- clever-PV

- reLi Energy

- Klimashift

These companies will present their solutions at our Call for Start-ups Pitch Event on February 11, 2025, addressing an audience of industry leaders, investors, and innovation stakeholders, including DSOs, TSOs, utilities, Stadtwerke, VCs, and accelerators.

📍 Join us at the 𝘍𝘶𝘵𝘶𝘳𝘦 𝘍𝘰𝘳𝘶𝘮 in Hall 5 at 11:00 to learn more about their work and explore potential partnerships.

Last year, this platform proved pivotal in fostering meaningful collaborations and advancing critical discussions on sector coupling, digitalisation, and green mobility. We look forward to continuing this tradition in 2025 and thank all the applicants for their contributions to driving the energy transition forward.

We hope to see you in Essen for E-world 2025.

Strata Virtual Pitch Event: Decarbonisation Innovations Shaping the Future

🌍Our Magaging Partner, Matthias Engel, is one of the featured investors of the “Strata Virtual Pitch Event: Decarbonisation Innovations Shaping the Future”.

Based in Berlin, Matthias brings decades of expertise in the energy industry and venture capital. At Vireo Ventures, he focuses on early-stage investments in energy tech, energy transition, and electrification. Previously, Matthias led corporate venture activities for major utility groups RWE AG and innogy SE and has been in the middle of the transitioning energy industry in the past 20 years, making him a powerhouse of knowledge in the energy sector.

Alongside other featured investors, Matthias will be exploring 5 startups decarbonisation and sustainability:

🚗 AI-powered battery tech for safer, cost-effective operations.

☀️ Solar cells replacing silver with copper—cheaper and greener.

🌬️ Wind propulsion cutting shipping emissions by up to 30%.

⚓ Zero-emission marine propulsion reshaping maritime sustainability.

🔋 Long-duration energy storage scaling from 10MW to 100MW.

👉 Register here: https://lu.ma/mcx7cuts

📅 See you at 15:00 CET on January 29th!

Vireo Ventures joins over 100 leading cleantech innovators and investors from across Europe in an open letter

Today Vireo Ventures joins over 100 leading cleantech innovators and investors from across Europe in an open letter calling on the European Commission to deliver an ambitious Clean Industrial Deal. The letter, addressed to Commission President Ursula von der Leyen and relevant Commissioners, emphasizes the urgent need for action in 2025 to address Europe’s geopolitical challenges, energy costs, and intensifying global competition.

To succeed on these fronts, the Clean Industrial Deal must send two clear market signals:

📈 Boost demand for cleantech: help industries become more competitive by adopting state-of-the-art cleantech, establishing lead markets, and integrating innovation into public procurement. This also includes maintaining the ambition of the Hashtag#ETS and Hashtag#CBAM – with startups such as ARTEM Technologie AG enabling efficient and effective reporting mechanisms.

💶 Unlock private capital through public de-risking: Expand EU funding and guarantees to mobilize Europe’s €38 trillion in private capital, scaling cleantech manufacturing while ensuring fiscal efficiency.

This is a make-or-break moment for Europe’s industrial future. With the right mix of policies and incentives, the Clean Industrial Deal can establish a compelling business case for clean technologies, drive industrial transitions, and pave the way for a prosperous and sustainable future for European citizens.

📄 Read the full open letter and join us in shaping Europe’s clean industrial future